· ask your community manager for access. The move, which will impact u. s. While india and kazakhstan face a 25% duty, laos and myanmar are subject to the highest rate at 40%. In recent years, tariff policies — particularly on american goods imported into india — have emerged as central issues in global trade negotiations and diplomatic dialogue. Need answers fast? If you’re experiencing an issue with the nextdoor app or website, the most effective way to let us know is to send us a message using our contact form. Made by your neighbors in san francisco, … Find what you need here. Below table has data from unctad trains for most favored nation (mfn) tariff and applied tariff applied by united states on imports from india. Businesses and consumers, is seen as a … The harmonized tariff schedule of the united states (hts) sets out the tariff rates and statistical categories for all merchandise imported into the united states. What’s the difference between customs duty and tariff? The order listed higher import duty … · the bilateral trade relationship between india and the united states has long been significant, albeit layered with complexities. Fill out our contact form and a member of our customer support team will respond within 24 hours. Learn how to report members or posts and how to handle conflict in your neighborhood. This measure, part of a new executive order, denies india product-level exemptions, even for critical sectors like pharmaceuticals and electronics. Effective , the us has imposed a blanket 25% tariff on all indian-origin goods, placing india among the most harshly treated nations in its new tariff regime. Nextdoor about news media assets investor relations blog careers help neighbors get started events neighborhoods guidelines anti-racism resources crisis hub business & organizations brands & agencies public agency businesses on nextdoor neighborhood faves self-service ad terms industries home & garden real estate professional services food. · we’ll explore the differences between customs duty and tariffs, their types, rates, and impacts, along with a deep dive into hsn and hts codes and the ongoing tariff tensions between india and the usa. We promise a 24-hour response time, 7 days a week. Contact us about an issue with the app or website. · depending on each country’s trade behaviour and current duty rates under the harmonized tariff schedule of the united states (htsus), new tariffs range from 10% to 41%. Check the list of goods, tariff rates on products, and products that are exempted from tariff, impact on markets, implementation dates and many more. Trump imposed an additional 25% tariff on indian goods. · us tariff on india: · president trump announced a 50% tariff on imports from india, citing their purchases of russian oil. Mfn and applied tariff are provided for both traded and non-traded goods. · with the newly announced 25 per cent additional tariff on imports, india has now joined brazil at the top of the list of countries facing the highest import taxes under president trump’s adjusted tariff regime. Starting , the us imposed a universal 10% tariff on all countries, followed by individualized reciprocal higher tariffs on nations with which the united states has the largest trade deficits. Can’t find the answer to your question?

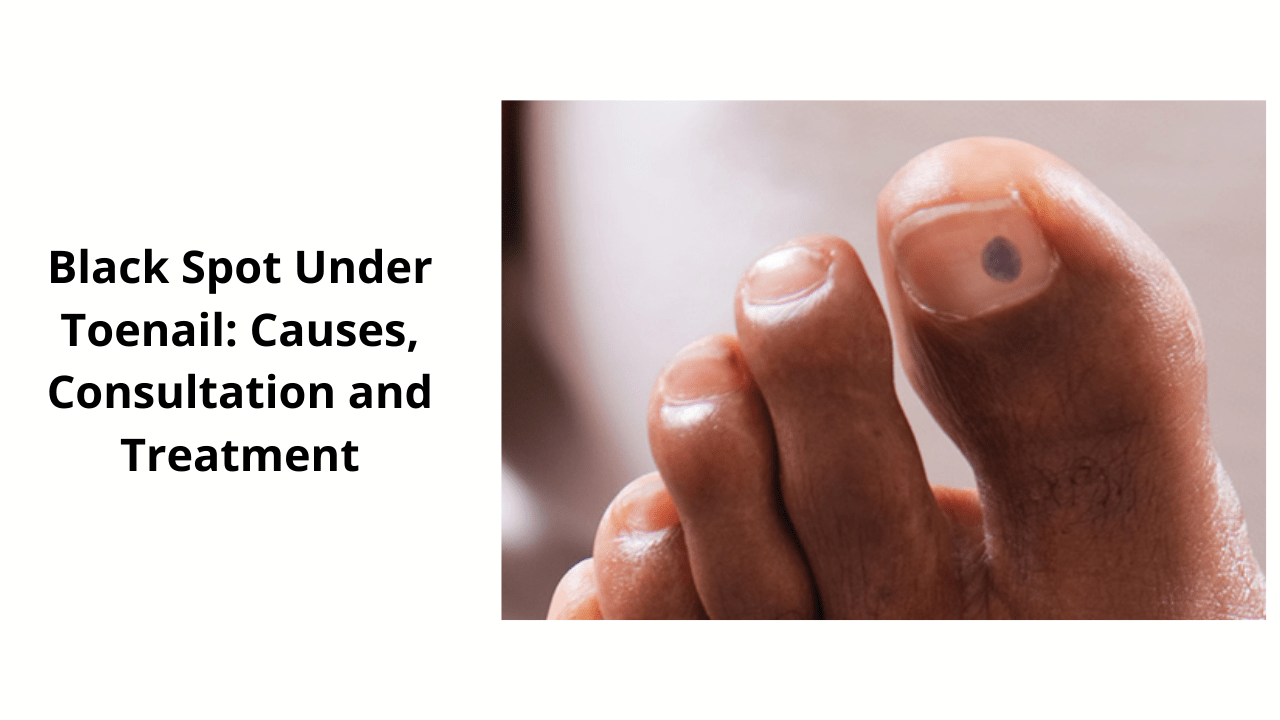

Quick! How To Tell If Your **Black Spot Under Big Toenail** Is Serious

· ask your community manager for access. The move, which will impact u. s. While india and kazakhstan face a 25% duty, laos and myanmar...